Source: Institute for Supply Management – May 1, 2019

Economic activity in the manufacturing sector expanded in April, and the overall economy grew for the 120th consecutive month, say the nations supply executives in the latest Manufacturing ISM® Report On Business®.

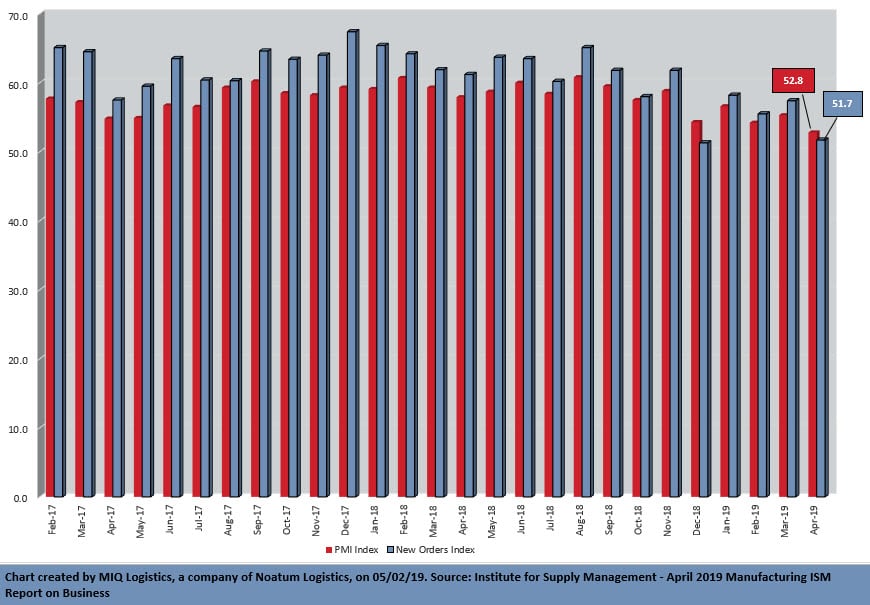

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The April PMI® registered 52.8 percent, a decrease of 2.5 percentage points from the March reading of 55.3 percent. The New Orders Index registered 51.7 percent, a decrease of 5.7 percentage points from the March reading of 57.4 percent. The Production Index registered 52.3 percent, a 3.5-percentage point decrease compared to the March reading of 55.8 percent. The Employment Index registered 52.4 percent, a decrease of 5.1 percentage points from the March reading of 57.5 percent. The Supplier Deliveries Index registered 54.6 percent, a 0.4-percentage point increase from the March reading of 54.2 percent. The Inventories Index registered 52.9 percent, an increase of 1.1 percentage points from the March reading of 51.8 percent. The Prices Index registered 50 percent, a 4.3-percentage point decrease from the March reading of 54.3 percent.

“Comments from the panel reflect continued expanding business strength, but at the softest levels since the fourth quarter of 2016. Demand expansion continued, with the New Orders Index softening to the low 50s, the Customers’ Inventories Index remaining at a ‘too low’ status, and the Backlog of Orders Index improving its prior month performance. Consumption (production and employment) continued to expand, but at lower levels, resulting in a combined decrease of 8.6 points. Inputs — expressed as supplier deliveries, inventories and imports — were higher this month, primarily due to inventory growth exceeding consumption, resulting in a combined 1.5-percentage point improvement in the Supplier Deliveries and Inventories Indexes. Imports contracted during the period. Overall, inputs reflect a more stable business environment, confirmed by the Prices Index at zero price growth, or unchanged.

“Exports orders contracted for the first time since February 2016. The PMI® trade elements are in contraction territory. The PMI® has been inching down since November 2018. The manufacturing sector is expanding, but at recent historic lows,” says Fiore.

Of the 18 manufacturing industries, 13 reported growth in April, in the following order: Textile Mills; Electrical Equipment, Appliances & Components; Miscellaneous Manufacturing; Printing & Related Support Activities; Chemical Products; Nonmetallic Mineral Products; Plastics & Rubber Products; Machinery; Furniture & Related Products; Food, Beverage & Tobacco Products; Computer & Electronic Products; Paper Products; and Fabricated Metal Products. The five industries reporting contraction in April are: Apparel, Leather & Allied Products; Primary Metals; Wood Products; Petroleum & Coal Products; and Transportation Equipment.

Click here to access the entire release from the Institute for Supply Management website.