Source: Institute for Supply Management – September 3, 2019

Economic activity in the manufacturing sector contracted in August, and the overall economy grew for the 124th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

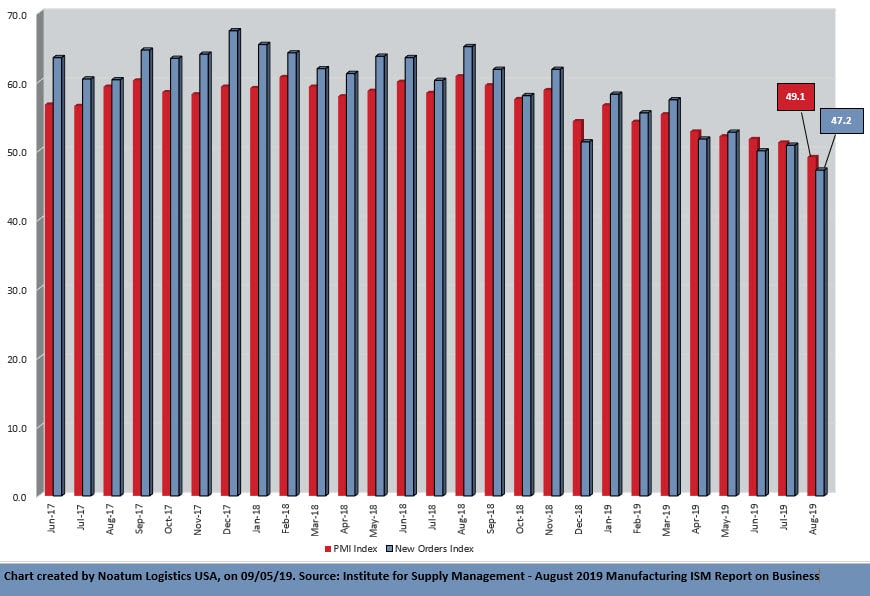

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The August PMI® registered 49.1 percent, a decrease of 2.1 percentage points from the July reading of 51.2 percent. The New Orders Index registered 47.2 percent, a decrease of 3.6 percentage points from the July reading of 50.8 percent. The Production Index registered 49.5 percent, a 1.3-percentage point decrease compared to the July reading of 50.8 percent. The Employment Index registered 47.4 percent, a decrease of 4.3 percentage points from the July reading of 51.7 percent. The Supplier Deliveries Index registered 51.4 percent, a 1.9-percentage point decrease from the July reading of 53.3 percent. The Inventories Index registered 49.9 percent, an increase of 0.4 percentage point from the July reading of 49.5 percent. The Prices Index registered 46 percent, a 0.9-percentage point increase from the July reading of 45.1 percent.

“Comments from the panel reflect a notable decrease in business confidence. August saw the end of the PMI® expansion that spanned 35 months, with steady expansion softening over the last four months. Demand contracted, with the New Orders Index contracting, the Customers’ Inventories Index recovering slightly from prior months and the Backlog of Orders Index contracting for the fourth straight month. The New Export Orders Index contracted strongly and experienced the biggest loss among the subindexes. Consumption (measured by the Production and Employment Indexes) contracted at higher levels, contributing the strongest negative numbers (a combined 5.6-percentage point decrease) to the PMI®, driven by a lack of demand. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in August, due to inventory tightening for the third straight month and continued slower supplier deliveries. This resulted in a combined 1.5-percentage point decline in the Supplier Deliveries and Inventories indexes. Imports and new export orders contracted to new lows. Overall, inputs indicate (1) supply chains are responding better and (2) companies are continuing to closely match inventories to new orders, a positive sign for future expansion. Prices contracted for the third consecutive month, indicating lower overall systemic demand.

“Respondents expressed slightly more concern about U.S.-China trade turbulence, but trade remains the most significant issue, indicated by the strong contraction in new export orders. Respondents continued to note supply chain adjustments as a result of moving manufacturing from China. Overall, sentiment this month declined and reached its lowest level in 2019,” says Fiore.

Of the 18 manufacturing industries, nine reported growth in August, in the following order: Textile Mills; Furniture & Related Products; Food, Beverage & Tobacco Products; Wood Products; Petroleum & Coal Products; Nonmetallic Mineral Products; Machinery; Miscellaneous Manufacturing; and Chemical Products. The seven industries reporting contraction in August — in the following order — are: Apparel, Leather & Allied Products; Fabricated Metal Products; Transportation Equipment; Primary Metals; Plastics & Rubber Products; Paper Products; and Electrical Equipment, Appliances & Components.

Click here to access the entire release from the Institute for Supply Management website.