U.S. Energy Information Administration

Key details from the latest Short-Term Energy Outlook released from the U.S. Energy Information Administration. Some of the highlights included the following:

- “EIA expects global oil inventory draws to begin in mid-2017. The expectation of inventory draws contributes to rising prices in the second quarter of 2017, with price increases continuing later in 2017. Brent prices are forecast to average $52/b in 2017. Forecast Brent prices average $58/b in the fourth quarter of 2017, reflecting the potential for more significant inventory draws beyond the forecast period”.

- “U.S. crude oil production is projected to decrease from an average of 9.4 billion b/d in 2015 to 8.8 million b/d in 2016 and to 8.5 million b/d in 2017. Production levels in 2017 for this forecast are 0.2 million b/d higher than in the August STEO. The upward revisions to production largely reflect an assumption of higher drilling activity, drilling efficiency, and well-level production than assumed in previous forecast”.

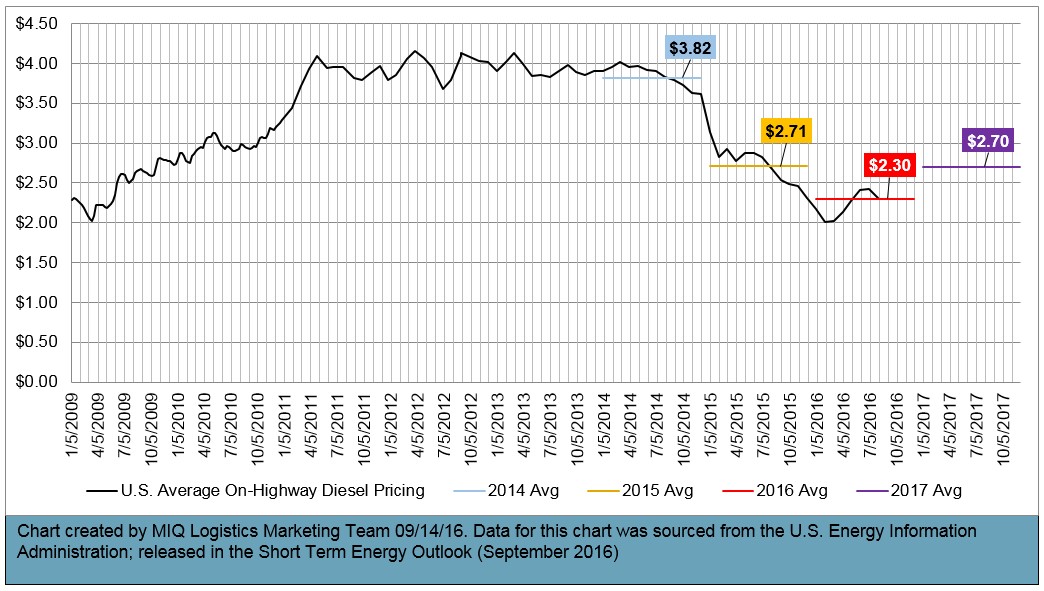

- “EIA expects that the U.S. average retail price of regular gasoline reached a peak of $2.37/gal in June and will fall to an average of $2.13/gal in September and to an average of $1.92/gal in December. The U.S. regular gasoline retail price, which averaged $2.43/gal in 2015, is forecast to average $2.08/gal in 2016 and $2.26/gal in 2017. The diesel fuel retail price averaged $2.71/gal in 2015. The diesel price is forecast to average $2.31/gal in 2016 and $2.70/gal in 2017”.

>> Click here to access the entire Short-Term Energy Outlook from the EIA.