Import cargo volume at the nation’s major retail container ports is expected to rise an unusually high 16.9 percent this month over the same time last year as West Coast ports begin to dig out from a backlog of cargo that built up during just-concluded contract negotiations with dockworkers, according to the monthly Global Port Tracker report released today by the National Retail Federation and Hackett Associates.

“The contract talks are over, but the tentative agreement still has to be ratified and it’s going to take months to get back to normal on the West Coast,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Retailers’ immediate priority is to make sure spring merchandise reaches store shelves in time. Going forward, we want labor, management and Washington to work together to see that we never again have a situation like what we went through these past several months.”

Following negotiations that began last spring, the contract between the Pacific Maritime Association and the International Longshore and Warehouse Union expired on July 1. Despite ongoing talks, the lack of a contract and other operational issues led to crisis-level congestion at the ports, and retailers and other businesses asked President Obama in December to encourage the use of a federal mediator. A mediator joined the talks in January but a tentative agreement was not reached until February 20, after Labor Secretary Tom Perez sat down to personally broker a deal.

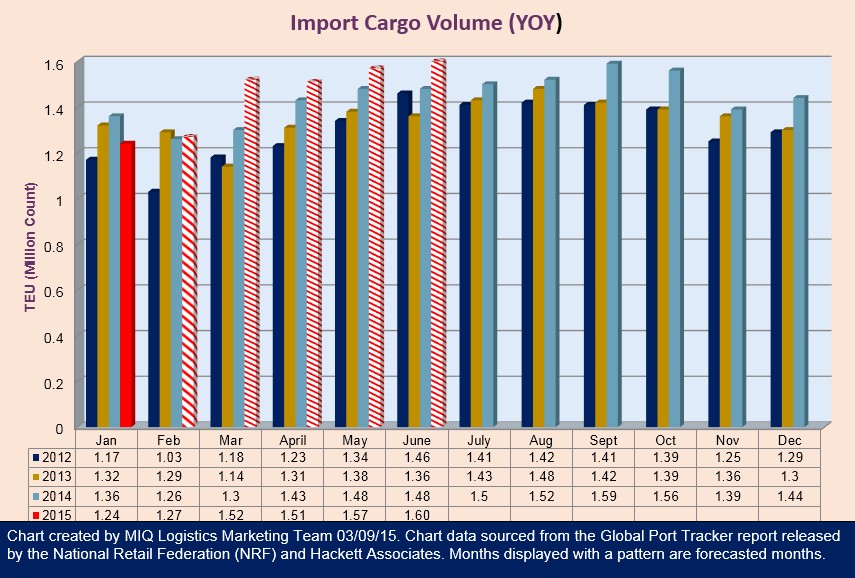

Ports covered by Global Port Tracker handled 1.24 million Twenty-Foot Equivalent Units in January, the latest month for which after-the-fact numbers are available. That was down 13.4 percent from December following the end of the holiday season and down 9.5 percent from January 2014. One TEU is one 20-foot-long cargo container or its equivalent.

February was estimated at 1.27 million TEU, up 2.3 percent from 2014. March is forecast at 1.52 million TEU as spring merchandise arrives, up 16.9 percent from last year. The March number is high both because of the backlog of ships at anchor waiting to be unloaded and because the annual Lunar New Year shutdown of Chinese factories was later this year, delaying some February cargo into March. April is forecast at 1.51 million TEU, up 5.2 percent; May at 1.57 million TEU, up 6.1 percent; June also at 1.57 million TEU, up 6 percent, and July at 1.6 million TEU, up 6.7 percent.

The first half of 2015 is forecast at 8.7 million TEU, an increase of 4.5 percent over the same period last year.

Congestion at West Coast ports has prompted many importers to shift their cargo elsewhere, prompting speculation on how long the shift might last. West Coast ports handled 55 percent of cargo this January, down from 64 percent during the same month in 2014, while East Coast ports handled 45 percent, up from 36 percent.

“Importers and exporters are reviewing their supply chain plans for the future, and not necessarily in favor of the West Coast,” Hackett Associates Founder Ben Hackett said. “Looking on the practical side, a number of factors favor a return to the West Coast.”

>> Click here to access the entire relase from the National Retail Federation.