Source: Institute for Supply Management, July 1, 2019

Economic activity in the manufacturing sector expanded in June, and the overall economy grew for the 122nd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

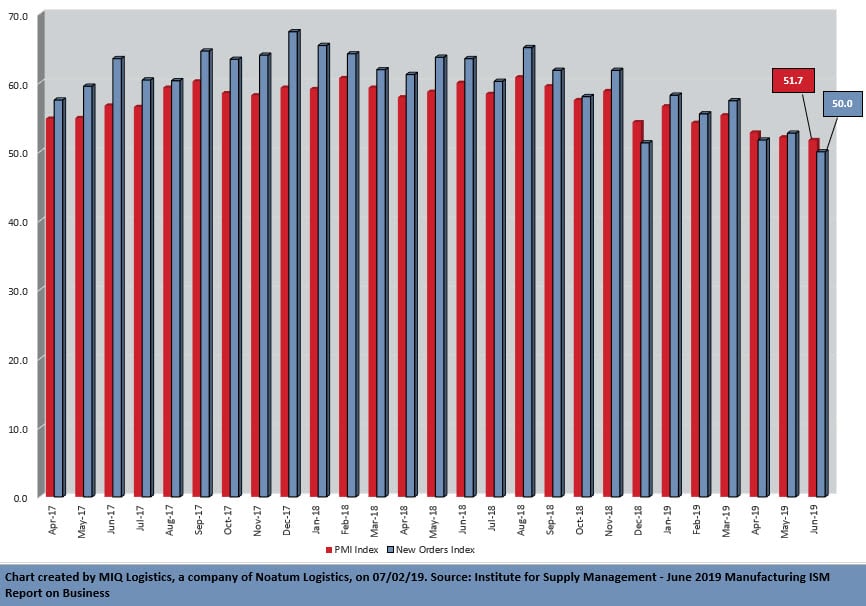

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The June PMI® registered 51.7 percent, a decrease of 0.4 percentage point from the May reading of 52.1 percent. The New Orders Index registered 50 percent, a decrease of 2.7 percentage points from the May reading of 52.7 percent. The Production Index registered 54.1 percent, a 2.8-percentage point increase compared to the May reading of 51.3 percent. The Employment Index registered 54.5 percent, an increase of 0.8 percentage point from the May reading of 53.7 percent. The Supplier Deliveries Index registered 50.7 percent, a 1.3-percentage point decrease from the May reading of 52 percent. The Inventories Index registered 49.1 percent, a decrease of 1.8 percentage points from the May reading of 50.9 percent. The Prices Index registered 47.9 percent, a 5.3-percentage point decrease from the May reading of 53.2 percent.

“Comments from the panel reflect continued expanding business strength, but at soft levels; June was the third straight month with slowing PMI® expansion. Demand expansion ended, with the New Orders Index recording zero expansion, the Customers’ Inventories Index remaining at a too-low level, and the Backlog of Orders Index contracting for the second straight month. New export orders remain weak. Consumption (measured by the Production and Employment indexes) continued to expand, resulting in a combined increase of 3.6 percentage points. Inputs — expressed as supplier deliveries, inventories and imports — were lower this month, due to inventory contraction and suppliers continuing to deliver faster, resulting in a combined 3.1-percentage point reduction in the Supplier Deliveries and Inventories indexes. Imports registered zero expansion. Overall, inputs indicate (1) supply chains are responding faster and (2) supply managers are again closely watching inventories. Prices contracted for the first time since February.

“Respondents expressed concern about U.S.-China trade turbulence, potential Mexico trade actions and the global economy. Overall, sentiment this month is evenly mixed,” says Fiore.

Of the 18 manufacturing industries, 12 reported growth in June, in the following order: Furniture & Related Products; Printing & Related Support Activities; Textile Mills; Nonmetallic Mineral Products; Food, Beverage & Tobacco Products; Petroleum & Coal Products; Chemical Products; Computer & Electronic Products; Paper Products; Miscellaneous Manufacturing; Electrical Equipment, Appliances & Components; and Machinery. The five industries reporting contraction in June are: Apparel, Leather & Allied Products; Primary Metals; Wood Products; Transportation Equipment; and Fabricated Metal Products.

Click here to access the entire release from the Institute for Supply Management website.