“Despite The U.S. LEI increased sharply in February, suggesting that any weather-related volatility will be short lived and the economy should continue to improve into the second half of the year,” said Ataman Ozyildirim, Economist at The Conference Board. “The strengths and weaknesses in the LEI were balanced in February, with large increases in housing permits and the interest rate spread more than offsetting decreases in the workweek in manufacturing, consumer expectations and rising initial claims for unemployment insurance.”

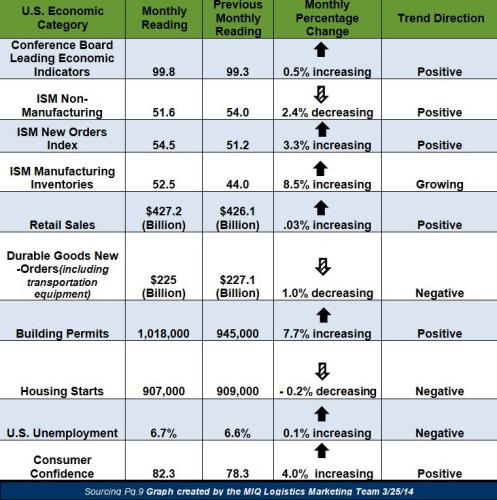

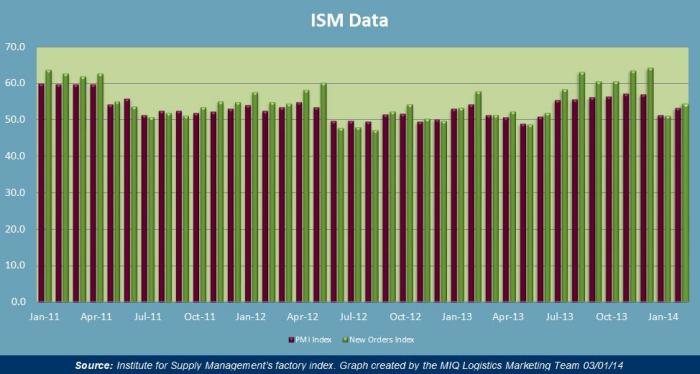

Institute for Supply Management (ISM) Manufacturing Report on Business

Economic activity in the manufacturing sector remained in expansion in February

- 50 represents the dividing line between expansion and contraction for the index of the below chart; which covers the Purchasing Managers Index (PMI) and new orders.

- The PMI registered 53.2% in February, which was 1.9% higher than January’s reading.

- New Orders increased in February by 3.3%.

Expanding Manufacturing Industries

- Textile Mills

- Wood Products

- Machinery

- Printing & Related Support Activities

- Plastics & Rubber Products

- Transportation Equipment

- Paper Products

- Food, Beverage & Tobacco Products

- Electrical Equipment, Appliances & Components

- Fabricated Metal Products

- Furniture & Related Products

- Primary Metals

- Chemical Manufacturing

Contracting Manufacturing Industries

- Apparel, Leather & Allied Products

- Petroleum & Coal Products

- Miscellaneous Manufacturing

Transportation Market Update

| Truckload Index Category | Monthly Reading | Previous Monthly Reading | Trend Direction |

| American Trucking Associations (SA) seasonally adjusted For-Hire Truck Tonnage | 127.6 | 124.1 | + 2.8% Increasing |

| Cass Freight Index Report Shipments | 1.073 | 1.000 | + 7.3% Increasing |

| Cass Freight Index Report Expenditures | 2.419 | 2.265 | + 6.8% Increasing |

| Freight Transportation Services Index (TSI) | 113.6 | 116.8 | – 2.8 Decreasing |

| Trucking Employment | 0 | + 3,100 jobs | No Change |

| NAFTA Statistics for August | 57.2% of the $90.1 Billion of U.S. – NAFTA trade was transported by truck in December; this is up 7.2% YOY | ||

“The index for each freight mode declined in January with the largest decline in trucking. These declines took place during a period of severe winter weather, which particularly hit the heavily populated parts of the country. Severe weather can affect the demand for goods to ship as well as the ability to move goods. The decline in freight TSI took place despite increases in employment and personal income in January. The Federal Reserve Board Industrial Production Index declined in January, with the Construction sector leading the decline.” – Bureau of Transportation Statistics

“It is pretty clear that winter weather had a negative impact on truck tonnage during February,” said ATA Chief Economist Bob Costello. “However, the impact wasn’t as bad as in January because of the backlog in freight due to the number of storms that hit over the January and February period.”

Global Market Update

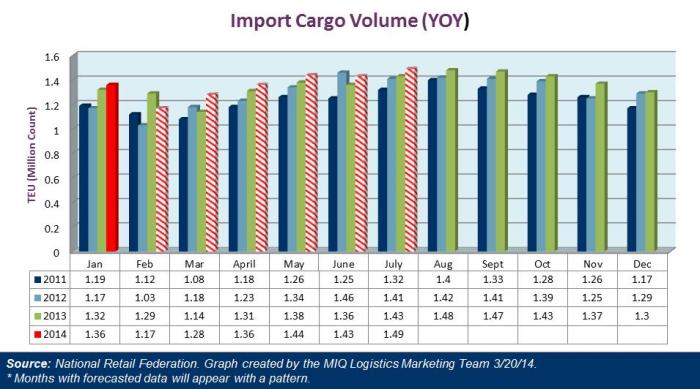

Recent Updates from National Retail Federation and Hackett Associates

- U.S. ports followed by Global Port Tracker handled 1.36 million TEUs in January, which was up 4.1% YOY from January 2013.

- “Retailers are bouncing back from the annual post-holiday slowdown and getting ready for the surge in activity that comes each year as the weather warms up” Vice President for Supply Chain and Customs Policy Jonathan Gold said.”

- While February is expected to witness 1.17 million TEU hitting U.S. ports, the month of March is forecast to hit 1.28 million followed by April at 1.36 million.

- As of March, the forecast for imported TEU’s to the U.S. during the first two quarters of 2013 will be approximately 8 million; if this forecast holds true it would be a 3.5% YOY increase.

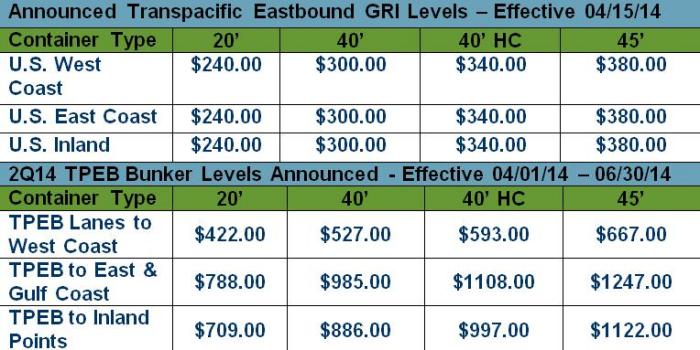

Transpacific Eastbound

*NOTE: The ocean carriers have announced their next round of GRI’s for 4/15/15.

With the implementation of a mid-April GRI, there is the potential for a manufactured peak in the weeks leading up to April 15th.

Transpacific Eastbound contracts run May 1st – April 30th. In regards to a 5/1/14 GRI, speculation is that the GRI levels will be the same as the April 15th GRI which is listed below. May 1 GRI levels will be announced by April 1st.

SOURCES

Domestic & Global Economy

- “February 2014 Manufacturing ISM Report on Business” – www.ism.ws 03/03/14

- “February 2014 Non-Manufacturing ISM Report on Business” – www.ism.ws 03/05/14

- “The Conference Board Leading Economic Index (LEI) for the U.S. Increased in February”– www.conference-board.org 03/20/14

- “Advance Monthly Sales for Retail and Food Services February 2014” – www.census.gov 03/13/14

- “Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders January 2014” –www.census.gov 02/27/14

- “New Residential Construction in February 2014” – www.census.gov 03/18/14

- “Employment Situation Summary” – www.bls.gov 03/07/14

Truckload Capacity & Volumes

- “Cass Freight Index Report” – www.cassinfo.com – Feb 2014

- “ATA Truck Tonnage Index Jumped 2.8% in February” – www.truckline.com 03/18/14

- “Freight Shipments Fell 2.8% in January from December” – www.rita.dot.gov 03/12/14

- “Employers add 175,000 jobs, but none in trucking” – www.thetrucker.com 03/07/14

- “ATA reports seasonally adjusted tonnage is up 3.6 percent in February” – www.logisticsmgmt.com 03/20/14

- “Three of Five Modes Carried More U.S.-NAFTA Trade in December 2013 than in December 2012” – www.rita.dot.gov 02/27/14

Global Market Update

- “Retail Imports To Rise in March As Retailers Stock Up for Spring” – www.nrf.com 03/10/14

- “February retail sales see gains, according to NRF and Department of Commerce” – www.logisticsmgmt.com 03/13/14