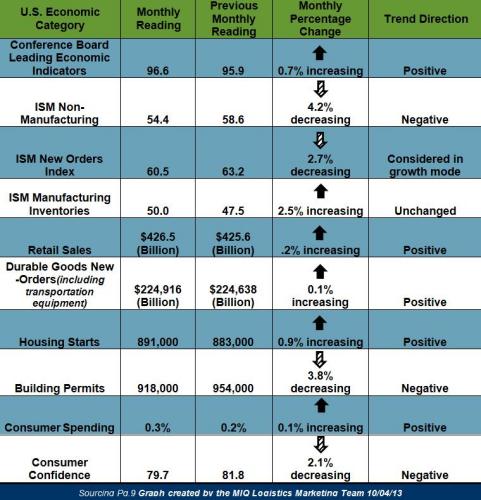

“After a brief pause, the U.S. LEI rose sharply in July and August, resuming its upward trend,” said Ataman Ozyildirim, Economist at The Conference Board. “If the LEI’s six-month growth rate, which has nearly doubled, continues in the coming months, economic growth should gradually strengthen through the end of the year. Despite weakness in residential construction, consumer expectations, and the stock market, improvements in the LEI’s labor market and financial components, as well as new manufacturing orders, drove this month’s gain.”

– Ataman Ozyildirim Economist at The Conference Board

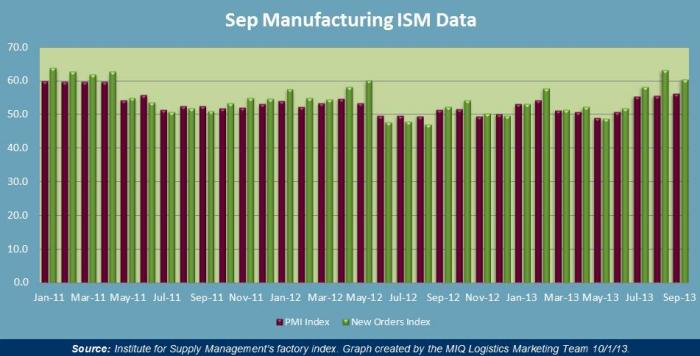

Institute for Supply Management (ISM) Manufacturing Report on Business

Economic activity in the manufacturing sector increased again in September

- 50 represents the dividing line between expansion and contraction for the index of the below chart; which covers the Purchasing Managers Index (PMI) and new orders.

- The PMI reading increased to 56.2% in September, which is 0.5 percentage points higher than the reading in August, which had read 55.7%.

- New Orders decreased in September by 2.7%; which lowered the reading to 60.5%.

Expanding Manufacturing Industries

- Electrical Equipment

- Appliances & Components

- Food, Beverage & Tobacco Products

- Furniture & Related Products

- Petroleum & Coal Products

- Fabricated Metal Products

- Paper Products

- Printing & Related Support Activities

- Transportation Equipment

- Computer & Electronic Products

- Machinery

- Plastics & Rubber Products

Contracting Manufacturing Industries

- Apparel

- Leather & Allied Products

- Primary Metals

- Textile Mills

- Nonmetallic Mineral Products

- Miscellaneous Manufacturing

Transportation Market Update

- “The strength in tonnage continued again in August, with the index increasing in three of the last four months,” ATA Chief Economist Bob Costello said. “The improvement corresponds with a solid gain in manufacturing output during August reported by the Federal Reserve last week.”

- “However, tonnage’s strength in recent months, and really through 2013, is probably overstating the robustness of the economy and trucking generally,” Costello said. “It just so happens that the sectors of the economy that are growing the fastest – in housing starts, auto production, and energy output, primarily through hydraulic fracturing – produce heavier than average freight, leading to accelerated growth in tonnage relative to shipments or loads.

- “Truckload industry loads have accelerated the last few months, but are flat for the year, while less-than-truckload shipments are up less than 1.5% in 2013,” Costello added.

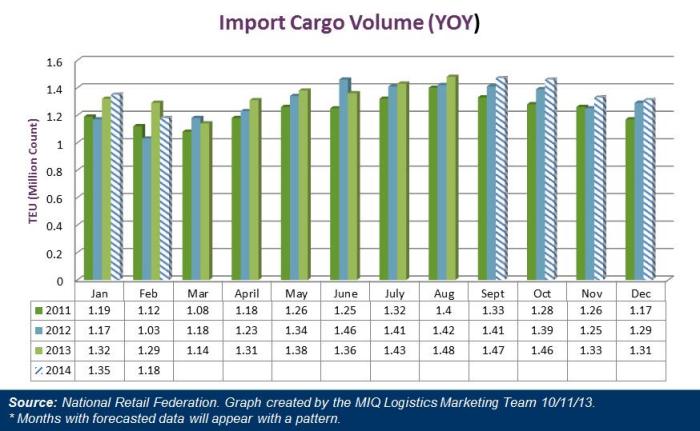

Global Market Update

- Import volume at the major retail container ports in the U.S. is expected to grow 9.1% in October (year-over-year).

- NRF (National Retail Federation) is predicting that this year’s holiday sales will be growing 3.9% year over year; reaching a total of $602.1 billion.

- “Our forecast is a realistic look at where we are right now in this economy – balancing continued uncertainty in Washington and an economy that has been teetering on incremental growth for years,” said NRF President and CEO Matthew Shay. “Overall, retailers are optimistic for the 2013 holiday season, hoping political debates over government spending and the debt ceiling do not erase any economic progress we’ve already made.”

Transpacific Eastbound GRI – Effective 11/15/13

| Container Type | 20′ | 40′ | 40′ HC | 45″ |

|---|---|---|---|---|

| U.S. West Coast | $320.00 | $400.00 | $450.00 | $506.00 |

| U.S. East Coast | $320.00 | $400.00 | $450.00 | $506.00 |

| U.S. Inland | $320.00 | $400.00 | $450.00 | $506.00 |

4Q13 TPEB Bunker Levels Announced — Effective 10/1/13 – 12/31/13

| Container Type | 20′ | 40′ | 40’HC | 45′ |

| TPEB Lanes to West Coast | $424.00 | $530.00 | $596.00 | $671.00 |

| TPEB to East & Gulf Coast | $780.00 | $975.00 | $1097.00 | $1234.00 |

| TPEB to Inland Points | $706.00 | $883.00 | $993.00 | $1118.00 |

SOURCES

Domestic & Global Economy

- “Global Business Cycle Indicators”– www.conference-board.org 09/19/13

- “Sep 2013 Manufacturing ISM Report on Business”– www.ism.ws 10/01/13

- “Sep 2013 Non-Manufacturing ISM Report on Business”– www.ism.ws10/03/13

- “Consumer Spending in U.S. Climbs 0.3% as Incomes Pick Up”– www.bloomberg.com 09/27/13

- “Consumer confidence dips as job outlook dims”– www.usatoday.com 09/24/13

- “Advance Monthly Sales for Retail and Food Services August 2013”– www.census.gov 09/13/13

- “Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders August 2013”– www.census.gov 09/25/13

- “New Residential Construction In August 2013”– www.census.gov 09/18/13

Truckload Capacity & Volumes

- “Cass Freight Index Report”– www.cassinfo.com – Sep 2013

- “BTS reports Freight TSI rises 0.3 percent in June”– www.logisticsmgmt.com 09/11/13

- “Freight Index Hits Near All-Time High”– www.truckinginfo.com10/09/13

- “ATA Truck Tonnage Index Jumped 1.4% in August”– www.truckline.com 09/24/13

Global Market Update

- “Retailers Stocking Up Ahead of Holiday Season”– www.nrf.com 09/09/13

- “Retail Imports Growing as Holidays Approach, Cargo Moving Despite Concerns Over Government Shutdown”– www.nrf.com

- “NRF Forecast Marginal Sales Gains This Holiday Season”– www.nrf.com 10/03/13

Government

- “NRF Calls for Immediate End to Government Shutdown Retailers Tell Washington to ‘Get Back to Work’”– www.nrf.com 10/9/13

- “Despite government shutdown, Port Tracker report calls for strong October import activity”– www.logisticsmgmt.com 10/08/13

- “U.S. exporters struggle with government shutdown”– www.logisticsmgmt.com 10/8/13